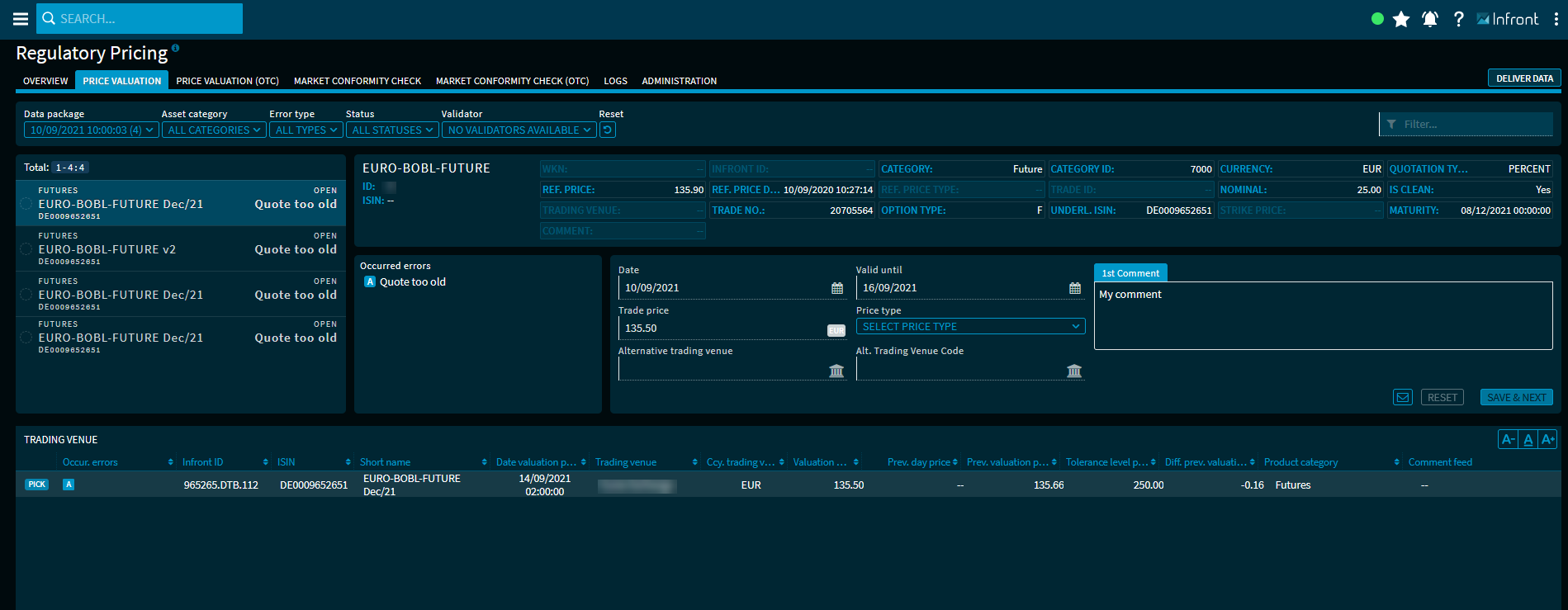

Regulatory pricing - Price valuation

Switch to the "Price valuation" tab to access this process.

In this area, you can identify, assign and validate prices for outliers.

The outliers are listed on the left-hand side. For each instrument, the name, security type (asset category), ISIN and, on the right-hand side, a short variant of the result or error type are displayed. The list is sorted by ISIN.

The icons that may be visible in front of the entries show status information of processes that have already taken place.

Example: Outlier with first validation

You can filter the list individually by using the filter elements above the list of results.

Select the relevant outlier to display its data in the analysis area.

Instrument area ("Widgetini")

In the "Price valuation" process, supplied client data is displayed in the instrument area at the top. This helps identify a sent instrument in case of errors of the category "Inactive", "Unknown", and so on.

This widget shows the following data for the selected outlier (if available):

| Element | Description |

|---|---|

| Name | The security name of the outlier. |

| ID | The individual client IDs of the outlier. |

| ISIN | The ISIN of the outlier. |

| WKN | The German security identification number of the outlier. |

| Category | The security type or asset category of the outlier. |

| Category ID | The category ID of the asset category of the outlier. |

| Currency | The currency of the outlier. |

| Price type | The quotation type of the outlier, for example "unit" or "percent". |

| Valid | The validity identifier ("IsCleanPrice") of the instrument ("Yes" or "No"). |

| Underlying ISIN | [For options and futures] The ISIN of the underlying of the option (or future). |

| Option type | [For options and futures] The option type of the option (or future) such as call ("C") or put ("P"). |

| Maturity date | [For options and futures] The maturity date of the option (or future ). |

| Strike price | [For options and futures] The strike of the option (or future). |

| Trading venue | [For options and futures] The trading venue of the option (or future). |

Status area

In this widget, the outlier result types are displayed. More than one entry is possible.

Example

The errors that have occurred are symbolised by different letters. These can be found in the list of trading venues below in the "Occurred errors" column (or "Occur. errors.") so that you can easily assign the entries.

Point to the respective result type in the status area to display the exact error code and additional information in a tooltip. You can filter the list according to the error codes. To do this, enter the corresponding code (such as "CHECK_FAILED_AGE" or "MISSING_DATA_CURRENCY") in the free text filter.

Validation area

On the left-hand side, below the instrument area, you see the validation area. Here you validate and comment on the price valuation for the selected instrument.

In the validation area, you find the following elements:

| Element | Description |

|---|---|

| Date | Use the integrated calendar to select the processing date. The default setting is the reporting date. If the data was set via the "Pick" button from the trading place list, manual overwriting is not possible. |

| Valid to | Use the integrated calendar to select the validity date of the price. The price may be valid only for the current price valuation date or until the date in the future specified here. After a selection, it is still possible to change the date in the "Valid to" field. |

| Trade price | Enter the relevant trading price into the input field. The corresponding currency is displayed at the right edge of the input field. It is also possible to enter "0" here. You can use the "Pick" button in the "Trading venues" list to show a value as an alternative to manual entry. If the data was set via the "Pick" button from the trading place list, manual overwriting is not possible. |

| Price type | Select the appropriate price type here for manually entered prices:

If the data was set via the "Pick" button from the trading venue list, then no selection is possible here. |

| Alternative trading venue | Here, you have the option to manually enter a trading venue for the security, for example, based on external research, in addition to the data in the list of trading venues. If the data was set via the "Pick" button from the trading place list, then no manually entry is possible here. |

| Alternative trading venue code | Here, you have the option to manually enter a trading venue for the security, for example, based on external research, in addition to the data in the list of trading venue code. If the data was set via the "Pick" button from the trading place list, then no manually entry is possible here. |

| Comment | Always enter a comment for your action in this input field. The title of the input field varies with the currently selected data - in the "First comment" example. If you have selected an entry from the list of trading venues via the "Pick" button, a comment in the form "Pick + 'trading venue'" (for example, "Pick Madrid" or "Pick Chicago") is automatically inserted here for information for validation, which can of course be edited. |

| "Reset" button | Click this button to reset your entries in the data fields on the left side of the validation area. The "Reset" button is enabled only if the data was loaded from the list of trading venues via the "Pick" button. When the entries were reset, then the "Date" input field will continue to show the report date and the "Valid to" input field will again show today's date. |

| "Save & continue" button | Click this button to complete the respective work step (for example, the initial validation of the entry) in the process. The data is then reloaded from the backend. This button is enabled only if a comment was also entered. |

"Contact" icon | Click this icon to contact us. In the menu that pops up, you can then distinguish between the following requests:

|

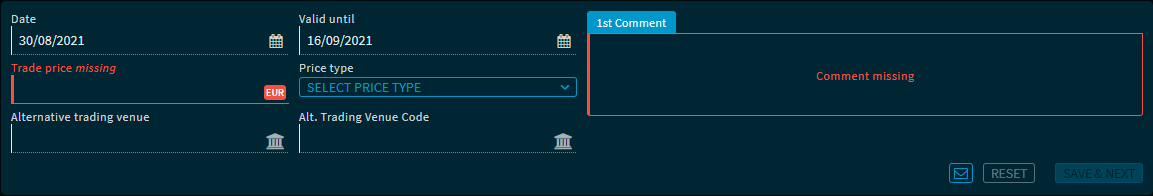

You can recognise missing data or entries by the colour highlighting of the fields:

List of trading venues

At the bottom of the "Price valuation" area, you see the list of available trading venues for the selected outlier. By default, the trading venue list shows the following columns in detail:

| Column | Description |

|---|---|

| [Selection buttons] Click this button to select this row or trading venue and to pre-screen the associated price as the trading rate as well as the date information in the validation area. A comment with the pattern "Pick + 'trading place'" (for example, "Pick Madrid" or "Pick Chicago") is automatically inserted in the comment field to provide information for validation. This data can be overwritten in the validation area. If the button is disabled, this entry cannot be selected, for example, error "922" (no rate in request currency available). Entries without a valuation rate cannot be selected either. If the list does not contain any trading venue in the requested currency, then a corresponding note will be displayed above the list. |

| Occur. error | In this column, you can see the assignment to the errors that occurred for each entry. Multiple errors can occur here. Example

The errors that have occurred are symbolised by different letters. You will also find these at the top of the status area so that you can easily assign the entries. |

| Infront ID | The unique Infront ID of the instrument. |

| ISIN | The ISIN of the instrument. |

| Short name | The security name (short name) of the instrument. |

| Date valuation price | Date and time of the last price valuation. |

| Trading venue | The trading venue of the instrument. |

| Currency trading venue | The currency of the instrument at the corresponding trading venue. |

| Valuation price | The valuation price of the instrument at the corresponding trading venue. |

| Previous day's price | Previous day's price of the instrument at the corresponding trading venue. |

| Previous valuation price | The last valid valuation price. |

| Tolerance level previous day [%] | The permitted difference in percent from the previous day's price. |

| Diff. previous valuation price | The (absolute) difference to the last valid valuation price. |

| Product category | The product or asset category of the instrument. |

| Comment Delivery | The specified comment on the delivery of this instrument. [Client data] |

Via the settings dialogue, you can also show the following columns:

| Column | Description |

|---|---|

| Tolerance level [%] | The permitted difference in percent from the previous day's price. |

| Date | Processing date and time of the instrument. |

| Date reference price | Date and time at the instrument's reference price. [Client data] |

| Date previous day price | Date and time of the previous day's price. |

| Diff. previous valuation price [%] | The relative difference to the last valid valuation price in percent. |

| Difference reference price | The (absolute) difference to the reference price. |

| Difference previous day's price | The (absolute) difference to the previous day's price. |

| Difference previous day's price [%] | The relative difference to the previous day's price in percent. |

| Client ID | The individual client IDs of the instrument. [Client data] |

| Price type | The quote type of this instrument, for example:

[Client data] |

| Price rule | The underlying price rule (number of the applied valuation price rule). |

| Price type | The type of the price, for example "Close" or "Open". |

| Avg. turnover 1M | The average turnover over one month of the instrument on the trading venue. |

| Avg. turnover 3M | The average turnover over three months of the instrument on the trading venue. |

| Product category ID | The unique ID of the asset category of the instrument, for example "1000" for the category "Equities and equity-like" or "4000" for the category "Certificates". |

| Reference price | The reference price of the instrument on the corresponding trading venue. [Client data] |

| Prev. Bid/ask spread | The (absolute) previous day's spread of the instrument at the trading venue. |

| Prev. Bid/ask spread % | The relative previous day's spread of the instrument at the trading venue in percent. |

| Ccy. Reference price | The currency of the reference price on the corresponding trading venue. [Client data] |

See also: