How to build times series with INFGET()

From the 27th of December 2021, FactSet source will be completely replaced and will be no longer available.

For any issue you may encounter, please refer to our recommendations and workaround. For more information about this process please follow our guidelines and information.

Using Excel Add-in functions you can easily retrieve a 10 years historic of values.

The INFGETHIST() function allows you to retrieve a historical table of time series points using array function. Though INFGETHIST() covers only market data (such as Close, MarketCap, Dividends....).

You can also use the INFGET() function to retrieve a history of time series points. It's pretty straitforward for most fields:

Market data or estimates (daily history)

For those, the 3rd parameter of the INFGET() formula is a date or referenced date.To retrieve the close price on the 15th of June 2021

CODEINFGET("30015NU","CLOSE","20210615")To retrieve the close price on the 1st day of the current year

CODEINFGET("30015NU","CLOSE","CYS")Financial data (annual or interim)

For those, the 3rd parameter of the INFGET() formula is a year, interim or referenced period.To retrieve the net sales of 2020

CODEINFGET("30015NU","SALES","2020")To retrieve the net sales of the last fiscal year

CODEINFGET("30015NU","SALES","LASTY")For certain fields, and in particular multiples, the historical value combine both a date and a period.

INFGET() function allows you to manage those more complex cases by using the 3rd and the 4th extended parameter with period and date.To retrieve the historical EPS of 2020 on the 15th of june 2019

CODEINFGET("30015NU","EPS","20190615","{'referencedperiod':'2020'}")

Guidelines

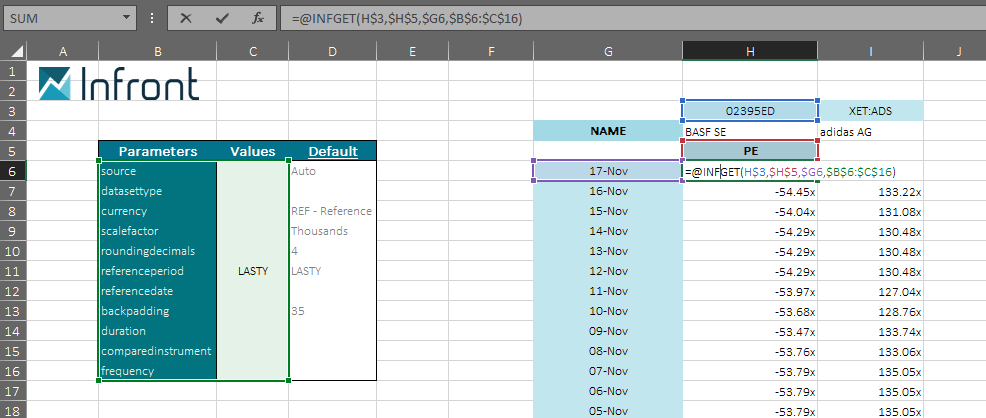

Multiples field are calculated using, for some, time series points. For those, you can use the INFGET() function combining the period and date parameters to retrieve a history of values.

To do so:

- Use the INFGET() Panel and select the company, the multiple and the LASTY period for example;

- Select the "Full Table" option in the output parameters;

- Once the new Infront worksheet is created, you can move any cell to personalize your model and change the references;

- Set the period selected in your formula in the advanced parameters table under "referenceperiod". Then erase the value in the cell below the one containing the Field name;

- Create a range of date, starting from Today for example, and set the date as the 3rd parameter of your INFGET() formula using cell reference;

- Drag down your formula to populate every cell next to your range of date with the value.

List of multiples concerned

- EV - Entreprise value

- EV/EBIT

- EV/EBITDA

- EV/SALES

- MC/TR - Market cap / Total revenue

- P/BOOK - Price to book

- P/CASHFLOW - Price to cashsflow

- PE - Price to earnings

Since v.3.38.0, two new models build following those guidelines are available in Excel Add-in Analytics Library:

- Time Serie history using INFGETHIST()

- Multiple and valuation ratio using INFGET()

You can also automatically opened them by copying the xml link bellow into a new browser window.

To access the "Time Serie history" model, click the "Copy" button on the right of the macro and paste it in a new browser window. If your Excel Add-in is installed, the corresponding Excel model will be opened automatically.

infrontxl://inline={'format':'xlEngineJob','xlPush':{'add-in':{'engineMini':'2.20.0.0','template':'TimeSerieHistory.xlsm'},'identifiers':{'company':' '}}}To access the "multiples and valuation ratios" model, same process using this link to paste in a new browser window.

infrontxl://inline={'format':'xlEngineJob','xlPush':{'add-in':{'engineMini':'2.20.0.0','template':'ValuationRatio.xlsm'},'identifiers':{'company':' '}}}